Enterpreneurs news

Enterpreneurs news

This Is How You Pay Less Tax as an Entrepreneur

We list the main deductions:

SME exemption: Every entrepreneur may deduct 14% of his profit, which reduces taxable profit.

Self-deduction: If you worked for more than 1225 hours in one year, you can deduct 7280 euros from your taxable profit.

Starter deduction: In the first three years, starters can make up a total of 2123 Euro extra deductions, in addition to the self-employed deduction. The exact rules can be found here.

Small-scale investment deduction: You may deduct 28% of the investments in your company.

WBSO: If you are researching or developing, this will be fiscally rewarded. The benefits for SMEs and ZZPs are different.

Energy and environmental investment deduction: Who invests in sustainability may deduct extra.

The government costs

Arrangements such as the self-employed deduction, the starters deduction and the SME benefit waiver cost the government annually. A survey by the research institute SEO Economic Research published last month shows that entrepreneurs made use of over 3.5 billion euros in 2015.

Thus, the State is missing a...

Why Going on Vacation Is Great for Productivity

Remember the care free days of childhood when the most stressful part of vacation was just the wait to get there? Thoughts of homework not finished or upset teachers never crossed your mind. Fast forward to present day where the days leading up to vacation have you feeling stressed and guilty. There is work left undone, someone else is taking over your responsibilities and there is no way they will do the same level of work as you. Taking vacation can almost be taboo at some companies, as if putting in 100-hourworkweeks makes for a better employee. Not the case! Here are 6 reasons why taking a vacation actually improves employee productivity at work.

1. You are happier- Coming back from vacation, you are less stressed, in a better mood, and have higher levels of energy. Employers who come back from vacation are more satisfied with their lives in general.

2. Good for your health- According to a study by University College London, people who work eleven hour days or longer are 67% more likely to develop heart disease than those who work seven or eight hours a day. Chronic stress can put a strain on your body and puts...

Dutch Construction Market Grows Faster Than the Rest of EU

In the first quarter of 2016, construction output in the Netherlands rose by 17%. That is considerably more than the average construction output in the EU, which increased in this period 7% above the lowest point of early 2013. Between early 2013 and mid-2014, the growth of the Dutch construction output remained below the European average.

In the EU the construction field is now 5.4% of the economy. The Dutch construction sector has a share of 4.6% less than the average in Europe. Relatively speaking, the greatest construction market is in Eastern European countries like Poland, Romania and Slovakia. In these countries, it is 8 - 9% of the total added value gained in construction.

The importance in the national economy is well reflected in the employment offered by the construction market of the countries. Of all employment in the EU, an average of 6.3% worked in construction with a total of over 14 million people in 2015. 457,000 of them were working in the Netherlands.

Source:...

Positive Reinforcement by Effective Managers

Positive reinforcement is"any pleasant or desirable consequences that follows a response and increases the possibility that the response will be repeated" (Wood& Boyd, 2005). This technique is used to stimulate and to strengthen new behaviors by offering rewards and incentives, as opposed to eliminating them.

Positive reinforcement thereby uses the reward system, which is a collection of brain structures attempting to monitor and control behavior by bringing about pleasurable effects. Rewards can be most useful in the workplace through monetary bonuses, promotions, praise, paid holiday leave, and simple attention. Giving rewards, by themselves, to employees may not result in the desired effect or behavior, but the reward must persuade the person to enact the desired behavior to be considereda positive reinforcement. The reinforcement should therefore be highly motivating to the individual. In the workplace, for example, a paycheck or a performance bonus can be a high motivation factor for many people, but not necessarily all.

B.F. Skinner was the first to introduce people to positive reinforcement by conducting experiments on animals. The most famous of these is his rat experiment where Skinner designed a box with a lever inside that released food when pressed. To see how a rat would...

The New Rules on Temporary Staff Were Not Successful

According to the research by labour market lawyers, the new legislation on redundancy and flexible employment has failed to boost job security for temps, as it was supposed to do.

Lodewijk Asscher introduced the new laws in 2015 and their aim was to encourage companies to put more staff on permanent contracts. However, the rules are so rigid that companies are actually being discouraged from taking on staff, according to the research, which involved over 1,000 lawyers and other specialists.

The new rules reduce the legal differences between traditional and temporary staff, and give temps more rights to severance pay and a permanent contract. In particular, temps who have had three contracts in two years are entitled to a permanent job.

The number of requests made in court to fire staff have roughly halved since the new laws were introduced and temporary staff are losing contracts more often, shows theresearch by lawyers’ organisations VAAN and VvA.

The chairman of small firms’ organisation MKB-Nederland told the Financieele Dagblad the new rules are a ‘major confirmation’ of the earlier criticism. Asscher has promised to make changes and ‘constructive’ talks are under way, Michaël van Straalen told the paper.

Sources: dutchnews.nl , fd.nl

...

Higher Investments in The Netherlands

Investment data are not adjusted for calendar effects. The number of working days was the same in April 2016 as in April 2015. According to Statistics Netherland's Investment Radar, the investment climate in the Netherlands is more favourable in June than in April and May.

Residential property investments rose further in April. Investments in infrastructural projects, aircraft, trucks and trailers also grew relative to April 2015.

The situation on the sales markets and on the financial markets is a relevant factor for the investment climate in general. The Investment Radar shows that export growth, consumer confidence and the mood among Dutch manufacturers about their order positions improved in June compared to April.

Source:https://www.cbs.nl...

What Does Brexit Mean for the Dutch Economy?

According to new figures from the national statistics office CBS, the Netherlands earned €20.5bn last year exporting goods and services to Britain, the equivalent of 3% of GDP. This makes the UK the Netherlands’ second most important export market after Germany. Belgium is in third place, followed by the US and France, the CBS said.

A British withdrawal from the EU will cost the Dutch economy €10bn in lost income by 2030, according to calculations by the government’s macro-economic think tank CPB last week. The drop in trade with Britain will mount up to 1.2% of GDP within the next 15 years, the CPB said.

Of the total production of goods and services in the Netherlands, 3.7% is with demand from the United Kingdom. This creates 300,000 jobs, or 3.3% of the Dutch employment, calculated as ING. Within the EU, only Ireland and Malta are more dependent on the United Kingdom.

Is it really so terrible?

At this point, much depends on the deal that will be reached afterwards. With a Norwegian model (participation in...

Business Starters Prefer Part Time Jobs

More than half of the starters in the Netherlands would like to begin as part-timers because they would like to maintain some form of financial security offered by a fixed job. This was reported in the research conducted by the Chamber of Commerce (KvK) in collaboration with the Free University.

29% of starters have hope to work full time as an entrepreneur at a later stage. According to the researchers the choice of entrepreneurship is often a choice for a new lifestyle. Four in ten aspiring entrepreneurs have already had their own business. Under latent entrepreneurs, those who dream about entrepreneurship but have no concrete plans, are 17%.

Aspiring entrepreneurs opt for their own business especially because they want to be their own boss, because of the personal challenge, and to be able to make a job from their hobby.

Source:

Nu.nl

...

The Number of Starters Increases in the Netherlands

On average North Holland have the highest number of entrepreneurs. For each 10000 inhabitants, the province has 203 starters. The average in the Netherlands is 156.

Source: Nu.nl...

Startup Fest started up in the Netherlands

Prince Constantijn— who is the new appointed special ambassador for startups—opened the Startup Fest on the 24th of May in Amsterdam. He said that he does not know whether startups will become the driving force behind the economy, “but they are important to renew the economy”, according to RTL Nieuws’ live blog on the event.

Within this five-day event, various startup giants are giving keynote speeches including Tim Cook of Apple, Eric Schmidt of Alphabet, Nathan Blecharczyk of Airbnb and Travis Kalanick of Uber.

Former Transit minister Neelie Kroes, already gave her speech and according to her, the belief that the Netherlands has few opportunities for growth is absolutely not true. Millions are available in the country, she believes, “But you must have a good business model, to show courage, and not be afraid to say what you think”.

Minister Henk Kamp of Economic Affairs announced that the Netherlands will be investing 50 million euros into helping startups and scale-ups to grow faster and stronger.

Source: NLTIMES...

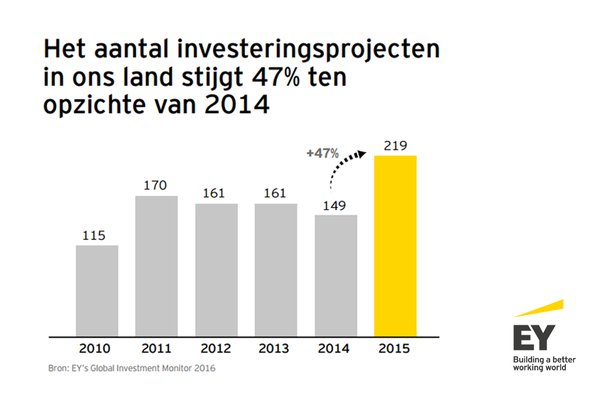

A rise of 47% Investments by Foreign Firms in the Netherlands

However, there is a cause for concern, according to the latest figures, because the confidence of foreign investors is declining in the Dutch business climate. This negative sentiment can translate into a lower level of total investment, giving rise to higher chances that new business in the Netherlands along with employment and knowledge can go wrong.

So it is important that not only existing interests are respected, but that there is sufficient focus on parts of the economy where in the coming years a strong growth is expected, such as start-ups and in the digital domain.

The Harvard Business Review research, quoted by EY, suggested that the Netherlands is losing its digital economy advantages, and risks trailing other countries in this field as development stagnates.

Source: Nu.nl...

Starting Your Company Brand in The Netherlands

If you are thinking about starting a company in the Netherlands, one of the first steps is checking that the proposed name or logo is unique, and can be protected from copycats. Your company brand will be distinguished by a word called a trademark (e.g. “Unilever” or “Heineken” – two world renowned Dutch trademarks). Even certain colours or shapes you create can become your trademarks (like the yellow and red shell from Shell Gasoline), but these will only be protected if they are registered.

After your trademark is registered, no one else can use it without your prior consent. Nor can a company use a name that’s similar to yours if there is a risk of confusing the two trademarks. To protect your trademark in the Netherlands, it must be registered at the Benelux Trademark Office (after which the trademark will be protected throughout the Benelux – Belgium, Netherlands, and Luxemburg). The registration costs €240, takes about four months to complete, and will be valid for a period of 10 years (after which it can be renewed).

If you conduct business outside the Benelux and require trademark protection in other European countries, you will need to register the trademark at...

Are the Big Firms Forced to Drop Freelancers With the New Changes of

According to BNR, recruitment agencies also notice much uncertainty among both clients and freelancers. D66 expressed great concern about these reports, and the parliamentarian Steven van Weyenberg suggested to monitor how this law is working in the coming weeks and months, and what will be the consequences for the freelancers.

Source: NL Times...

Eight Ways to Slow Down and De-Stress Your Busy Life

1. Do one thing at a time.

This statement was backed up by relevant research at the Stanford University. The researchers found that “multitaskers were terrible in all three experiments, worst of all the researchers found that when frequent multitaskers attempted to focus on a single task, they used their brains less effectively than non-frequent multitaskers.” Instead of stressing yourself with many things at the same time, focus and finish one thing first, and then move to the next task.

2. Double the estimate of how long anything will take.

Underestimation of the time needed to complete a task brings you unnecessary stress to your life. Instead, you can double the time needed for task completion. For example, if you plan to spend 30 minutes editing an article you just wrote, extend that to an hour, so...

Minister wants more MBO internship with freelancers.

According to Bussemaker thease are mainly very specialist and creative professions such as for example gold- and silversmiths. They often work independently.

Parliament had asked the minister to seek more opportunities to create internships by such professionals.

Many MBO students struggle to gain experience in practice, while it is necessary to complete their education . However an internship by a freelancer should be a match with the education of the student, only then a student can follow it, thinks Bussemaker .

Source: NU.nl...

Owch, I'm growing!

You are an entrepreneur and have set up a beautiful business. Your company has a loyal and committed staff, willing to invest in new clients. Your business is growing and is ready for the next step. But what themes can be used to stimulate growth? Moreover, what could hurt that corresponding growth? What does this mean for your own role in the company?

A development in the growth of organisations is described by the American organisation expert Larry E. Greiner In 1972, he developed the 'Greiner Growth Model' which describes the phases a business goes through as it grows. He maintains that a growing organisation experiences six different phases. Each stage marks a growth trajectory and will conclude with a brief 'crisis'. In this article, I will discuss the first phase, because the companies I advise often undergo this first crisis, and it is important to properly manage or avoid it.

The first phase is called “growth through creativity.” A small young company always starts in the "pioneer phase". Through further growth in size and years of life, the organization becomes more complex and can coordinate much more efficiently; the internal control of the company can no longer be managed...

More start-ups, less bankruptcies

This comes from figures published by the Chamber of Commerce.

Last month, more than fourteen thousand start-ups were begun, 4 percent more than in October last year. In 60 percent of cases, they were self-employed, while Small-to-medium entreprenuers grew to nearly sixteen establishments.

However, this was not the case for places such as Groningen and Overijssel, at odds with the national trend. These two places saw a decrease in the number of start-ups by 12 and 17 percent respectively.

The number of stoppers also rose by 4 percent, to over seven thousand. North Holland had the largest number of entrepreneurs (1,438) throwing in the towel, while Zeeland saw a total of 104 entrepreneurs stopping, showing a decline of 22 percent.

This year, the number of companies that went down with the ship was 17 percent lower than in November 2014. The regional differences were great. The lion's share of bankruptcies occurred in South Holland....

Adapting rules to ease implementation of participation act

Former students who come from secondary special education without review by the UWV are to be admitted directly to the target group for new jobs that will become available for people with an occupational disability. There will also be a simpler design of salary valuation in the workplace, especially where employers and municipalities have urged. These measures make it easier for people who do not earn the minimum wage to be placed on salary valuation because of a limit on extra jobs.

Employers and communities have the opportunity to charge for the first six months of employment a predetermined wage subsidy of 50 percent of the minimum wage for workers in the jobs target appointment. After that first half year, wage value in the workplace is determined and the wage is adjusted accordingly. Municipalities also have the freedom to deviate from the regular opportunities to redefine one's salary value.

The letter on the agreements which Secretary Jetta Klijnsma sent to parliament shows that previous measures...

Law for Whistleblowers: internal reporting regime

In recent years, there have been many cases where whistleblowing leads to a great deal of publicity of the workers faced through the work of doing wrong in the eyes of the public interest. Often they were in trouble because they brought out the abuse made by companies. This prompted the House of Representatives to come to an agreement on a new act for whistleblowers, which enhances the reporting capabilities as well as the protection of workers.

The law also provides for a House for Whistleblowers, that employees with a suspicion of wrongdoing by a public interest will be able to advise. The House will also do research into the alleged misconduct and the way in which the employer has acted.

The advice bureau for Whistleblowers advises employers not to wait until April 2016, but in time to establish a (modified) internal reporting scheme. This will facilitate the best possible employers in the private and semi-public sector....

New research shows social innovation determines success of technological innovation

This is evident from the research presented on Thursday by the Erasmus Competition and Innovation Monitor 2014-2015, which annually assesses the state of Dutch innovation. The amount of new products and services has surged by 3.5 percent and the amount of improved products and services increased by 5.2 percent. However, investment towards research and development within Dutch companies has fallen by 1.9 percent in the past year. This is a continuing trend since 2009.

Management Layers deleted

Prof. Henk Volberda, professor of strategic management and business policy and leader of the research, said the decline may threaten innovation and competitiveness of Dutch business. The improving economy has led to an increase in the number of product and service innovations. This growth, according Volberda, could otherwise be explained in large by a removal of layers of management. The concequence of this is that companies are less hierarchically organised and often collaborate...

More business people stay overnight in The Netherlands

This appears evident from the Trend Report on tourism, recreation and leisure in 2015 undertaken by the Centraal Bureau voor de statistiek (Central Bureau of Statistics, CBS) and the tourism office.

The first half of 2015 saw a continuation in this growth, with the number of commercial overnight stays increasing by 2.8 percent. Business tourists are responsible for two of the five nights in Dutch hotels. Most foreign business travelers who stayed in hotels come from Britain, the United States, Germany, China, Italy and Japan. Most business tourists, around 6.9 million, slept in North Holland, especially Amsterdam in 2014.

Business travelers spend more money on their trips than vacationers. They spent on average 350 euros per person per trip in 2013. The average Dutch holidaymaker spent an average of 166 euros per person per holiday in 2014. Foreign business travelers spend the most. Last year was an average of 1,035 euros per person per trip, while foreign holidaymakers on average 600 euros per person in expenditures.

Source: Nu.nl...

How to make new employees more productive

The analytics team at Google has set up several experiments to measure the factors that contribute to the productivity of new employees. What they have found is that it making a productive new employee comes from both sides, the employer and the employee.

Sending an e-mail to the manager as a new employee, but just before you start working, turns out to have the most impact. Sending a simple email before you begin work as a new employee is one way of finding out what is the minimum required level of productivity, allowing you to gain a headstart. This is also faster than when this reminder is not controlled.

The content of the mail is important. This can be considered a 'just-in-time' reminder mail, where you can highlight five things that have the most impact on the productivity of the starting staff. Managers may choose...

Changes to annual accounting legislation on November 1

The main change is how small and medium businesses are defined by size. Until now, small businesses must have a maximum balance sheet total to, but not exceeding €4.4 million and a maximum net turnover of €8.8 million. Fitting into this category allows the business to qualify for exemption from audit. With this exemption, these companies have only had to disclose a limited balance. However, under the new rules, the maximum balance sheet total may rise to €6 million and net sales to €12 million. The limit on the number of employees remains fifty.

Another important change is the addition of a new category, the micro enterprise. This new category applies to companies that have a maximum balance sheet and a net turnover of up to €350 thousand and no more than ten employees. These micro enterprises only need to draw up a limited statement.

The editing and publishing deadlines for financial statements...

Cabinet proposes new law on self-employed to be postponed

'The preparation goes on, but we are not there yet,' wrote Wiebes to the Senate. The Senate would be discussing the implementation of the plan by late October, but now it's off. Wiebes is now aiming to replace the VAR by April 1, 2016.

Freelancers have to work with a VAR, as required by the tax authorities. The government wants that because people can work as freelancers on paper, but are actually employed in practice. This is difficult to control for the tax authorities, and if it leads to problems, the financial consequences are always the self-employed.

Model Agreements

In the new structure, the tax authorities will be working with model agreements by sector that freelancers and companies can use. Companies can get certainty in advance as to whether the tax authorities accept that there is no employment. If there is, then contributions must be paid.

D66 senator Rinnooy Kan considered...

Sick pay to be reduced to one year

Last Friday, the Cabinet ruled on this wage/salary change, after which Minister of Finance Asscher made the change publicly known. 'Sick Pay is a huge problem, particularly for small businesses,' says Asscher. The former rulings on sick pay may deter employers to recruit staff.

The wage/salary would have to be paid for from the collective employer contributions as well as from Government contributions, which would amount to 20 million euros being earmarked. The intention of this is to ensure the employee does not go back on their decision.

It is not the first time that discussions on changes to the sick pay have taken place. Earlier this year a majority in the House of Representatives had already asked for Asscher to look towards this change. Asscher hopes that by November or December the 'knot will be tied,' after he has been talking with employers, trade unions and the government.

Source: P&O Actueel...

Stress greatly affects entrepreneurial performance

Josette Dijkhuizen highlights this as part of her PhD at Tilburg University. Her survey of 277 businesses shows that feelings of uncertainty, risk and responsibility as well as being available at all times greatly affect entrepreneurs’ stress perception. They can achieve a significant competitive advantage when they learn to cope with occupational stress, says Dijkhuizen. She further claims that entrepreneurs need to have inspiration in order to be successful. Consultants and coaches are supposed to provide enthusiasm and inspiration during trainings.

Dijkhuizen is going to take her doctoral degree on Thursday 25 June in the field of Human Resources Studies. She also works as a entrepreneur(ship) consultant and is an author of numerous management books.

By: C.Maiko Schnelle ...

New, Heavier Tax Burdens for Freelancers in the Netherlands

Many may be surprised to know that freelancers unlike most traditional workers in The Netherlands are required to pay taxes on their income before it is actually received. As if this long-standing regulation is not binding enough, the government has now placed additional constraints on freelancers that may generate billions in tax revenue per year.

Income tax for freelancers in The Netherlands, it seems, is an unsettling balance between efficient planning and pure chance. While most employees are taxed via the pay-as-you-earn (PAYE) income withholding, freelancers however, are taxed via voorlopige aanslag (provisional assessment) and pay income tax on earnings in-advance of them ever being received.

Each year, the belastingdienst (Dutch tax administration) calculates the expected net income of each freelancer through the voorlopige aanslag and requires payment of income tax in equal monthly installments for that year. If freelancers’ actual income is less or more than the pre-determined amount, they are either compensated what they overpaid or charged interest on the income that’s above the calculated amount.

To make matters worse, in 2014 the government added a clause to the Algemene Wet Inzake Rijksbelastingen (General Tax Act) which allows hefty fines to be levied when actual net earnings are inconsistent with those...

Four in 10 ZZP’ers are not setting aside money for pension

Insurer, Centraal Beheer released the results on Tuesday, 17 February from conducting a research with 539 ZZP’ers.

One in five (21%) Dutch freelancers assume that their monthly retirement income is not enough and more than half (57%) expect to work after retirement.

The report also stated that more men who are self-employed put money aside for pension compared to their female counterparts. Forty-eight percent of male freelancers are currently saving for their pension compared to only 35% of women.

Since the beginning of 2015, freelancers have the option of using insurance providers to build their pension fund, says NU.nl. Pension administrator APG in January launched a flexible pension fund for self-employed people. Start-ups Bright Retirement and Insurance Brand New Day have recently launched plans for freelancers.

...

New visa has been launched for ambitious entrepreneurs looking to start a company in the Netherlands

The Expatcenter Amsterdam is very pleased to announce that as of 1 January 2015, a new visa has been launched for ambitious entrepreneurs looking to start a company in the Netherlands. You can find all information about the new start-up visa on our website, along with a link to the IND’s official application form.

New salary requirements for highly skilled migrant status and 30% ruling

The salary requirements for highly skilled migrants as per January 2015 are as follows:

Highly skilled migrants of 30 years and older: EUR 4,189 gross per month excl. holiday allowance.

Highly skilled migrants younger than 30 years: EUR 3,071 gross per month excl. holiday allowance.

Highly skilled migrants who graduated in the Netherlands and who started working as highly skilled migrants in the first year following their graduation: EUR 2,201 gross per month excl. holiday allowance.

The salary criteria for the 30%-ruling as per January 2015 are as follows:

The annual taxable salary for an employee must be more than EUR 36,705 (2014: EUR 36,378).

The taxable salary for an employee with a master’s degree and who is younger than 30 years, must be more than EUR 27,901 (2014:...

Dutch freelance market sees improvement

The Dutch freelance market is improving, reported by NU.nl on Tuesday 27th January 2015.

This is evident from the Freelance Market Index (FMI), which indicates how the freelance market develops. The index has risen from 213 to 240 points.

Rob Berger, CEO of Freelance.nl. said that the growth of the freelance market is due to the trend of work becoming more flexible. He also stated that clients and contractors want flexible work or projects. “The number of freelancers and self-employed people increases because the workload grows."

According to NU.nl, Freelance.nl website posted a 20% increase. There were especially more assignments in the ICT sector. Bergers expects the market will continue to improve in 2015. He sees that the notion has changed.

The FMI is based on an analysis of figures from Statistics Netherlands (CBS), the General Union of Temporary Employment Agencies (ABU) and Freelance.nl.

Last week, figures from payroll company Tentoo showed that freelancers’ average turnover in 2014 saw a rise of 6.7%.

...

For an expat moving to the Netherlands, getting the right direction is very important. It's important that one knows which steps and direction to take. Linda is an exceptionally talent counselor, her advice has helped me land a job within a week of coming to the Netherlands. I am grateful for her mentoring and look forward to a great working relationship in the future.

Dr. Hrishiraj S | Clinical Research & Affairs Manager

Together Abroad provided expert advice on personal branding including developing a top-notch, market-aware CV, highly tailored job applications, and approach strategies with potential employers in the Netherlands. Furthermore, I found them be highly knowledgeable in key related fields such as recruitment strategy, immigration law, contracts, labor agreements, and (un)employment benefits. I would recommend Together Abroad to anyone who needs professional help with transitioning to a new career.

A. Aboufirass | Structural Engeer

Linda is a big mind. She thinks about things that the rest normally overlook. The insight she has about the dutch job market can only be achieved through years of experience and persistence.

Her business savvy is complemented by her mastery of understanding the client's needs and requirements. For my career I could say, she was the “Mary Poppins”, who guided me through thick and thin and helped me to land a career in the Netherlands

S. Bhattacharjee | FP&A Manager

Mr. C. Joubert

Lead Workplace Strategy Consultant